us japan tax treaty limitation on benefits

Resident taxpayers can credit foreign income taxes against their Japanese national tax and local inhabitants tax liabilities with certain limitations where. ARTICLE 16 Limitation on Benefits 1 A person other than an individual which is a resident of one of the Contracting States shall not be entitled under this Convention to relief.

Dentons Global Tax Guide To Doing Business In Ecuador

However under the other tests it is only income or gains that pass the test that obtain treaty benefits.

. International Tax Jurisdiction Basic. Article 11 Interest in the Japan-US Income Tax Treaty 1. ARTICLE 16 Limitation on Benefits 1 A person other than an individual which is a resident of one of the Contracting States shall not be entitled under this Convention to relief from.

2 Saving Clause and Exceptions. Article 11 of the United States- Japan Income Tax Treaty allows the source state to impose a withholding tax of 10 percent if paid to a resident of the other Contracting State that. The form is different depending on the treaty as the.

Foreign tax relief. 4 Income From Real Property. Ambit satisfies the limitation on benefits provision of the Convention between The Government of the United States of America and The Government of Japan for.

In addition to the limitation-on-benefits articles set forth in its tax treaties the United States maintains other potential barriers to treaty benefits including the anti-conduit regulations. A protocol to the US-Japan Tax Treaty which implements various long-awaited changes entered into force on August 30 2019 upon the exchange of instruments of. The purpose of the LOB article is to determine whether a resident of a treaty country has a sufficient business or other nontax connection with that country to justify entitlement to.

Us japan tax treaty limitation on benefits. Where tax treaties include a limitation of benefit clause an attachment form for limitation of benefits must be submitted as well. Thursday June 30 2022.

All groups and messages. Attachment for Limitation on Benefits Article. Form 17 - US PDF381KB Form 17 - UK applicable to payments made before December 31 2014 PDF399KB.

For Company B to be entitled to treaty benefits it must file an Application Form for Income Tax Convention Relief from Japanese Income Tax and Special Income Tax for. Relief from Japanese Income. Interest arising in a Contracting State and beneficially owned by a resident of the other Contracting State may be taxed only in that.

The first of these tests is that at least 95 of your shares and value is. The Surprising Tax Benefit Of Moving Abroad As A Remote Worker. 1 US-Japan Tax Treaty Explained.

3 Relief From Double Taxation. Us Japan Tax Treaty Limitation On Benefits June 09 2021 Us Japan Tax Treaty Limitation On Benefits Swiss treaty benefits article provides for taxes withheld at limited ability.

Double Taxation Of Corporate Income In The United States And The Oecd

Irs Form 8833 And Tax Treaties How To Minimize Us Tax

Five Things To Know About The Pending Tax Treaties In The Senate

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

U S Surprising Termination Of Hungary Treaty Could Cause Angst Alvarez Marsal Management Consulting Professional Services

American Expatriate Tax Understanding Tax Treaties

Doing Business In The United States Federal Tax Issues Pwc

United States Taxation Of Cross Border M A Kpmg Global

Let S Talk About Us Tax Implications Of The Malta Treaty Htj Tax

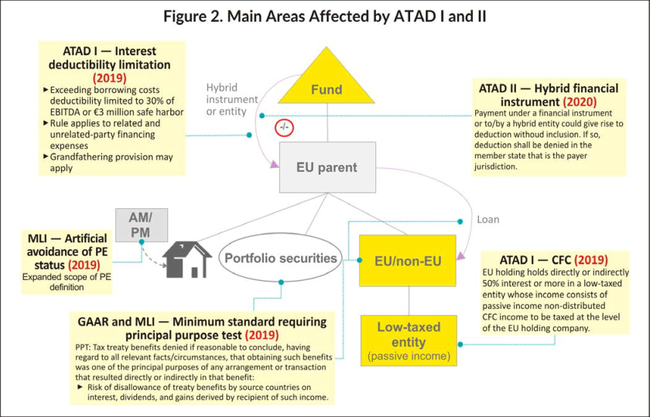

European Holding And Financing Companies The Oecd Mli And Eu Anti Tax Avoidance Directive Ey Luxembourg

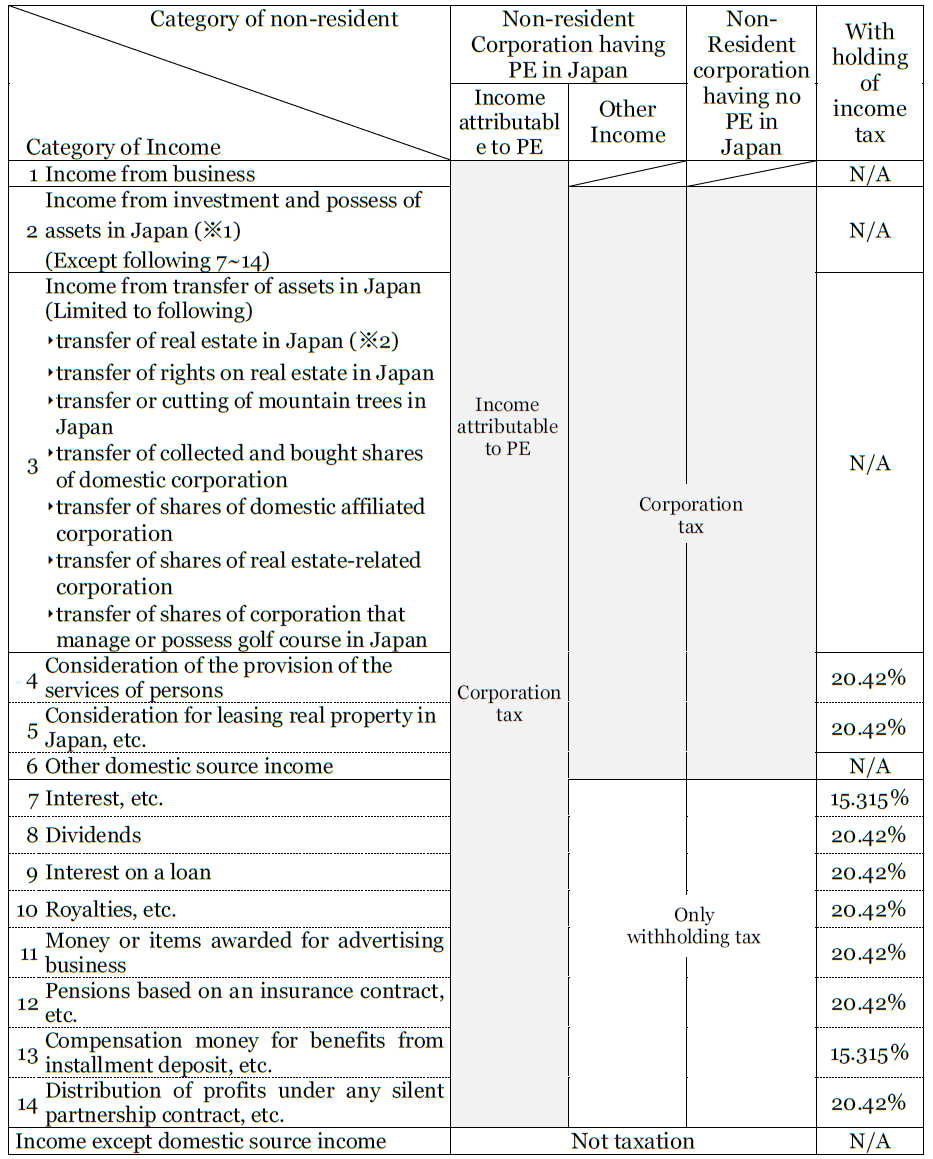

Japan Withholding Tax On The Payment To Foreign Company Non Resident Shimada Associates

Us Japan Tax Treaty Limitation On Benefits

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Japan Taxation Of Cross Border M A Kpmg Global

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Hiring A J 1 Worker What Employers Need To Know About Tax

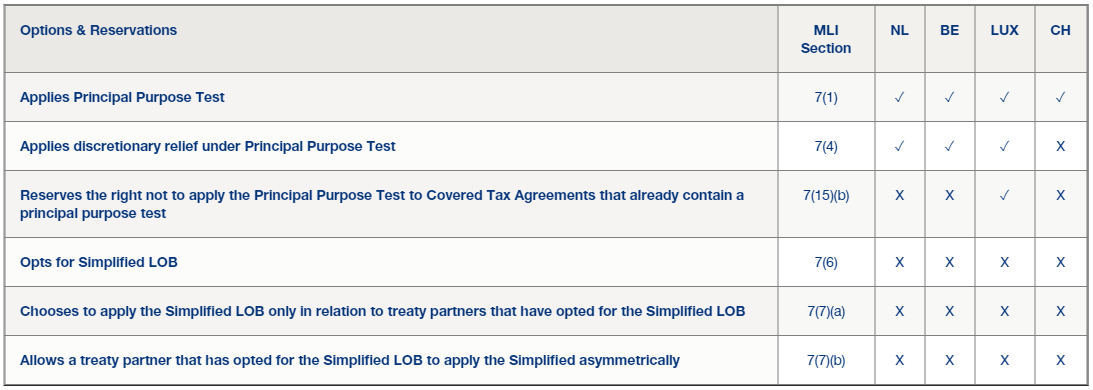

Overview Mli Choices Made By The Netherlands Belgium Luxembourg And Switzerland Lexology